Five hundred years ago, Europeans ventured into the interior of South America searching for a city they believed was rich in gold. Today’s El Dorado is where Europeans (and others) now go searching for contracts for one of the 21st century’s most valuable metals: lithium.

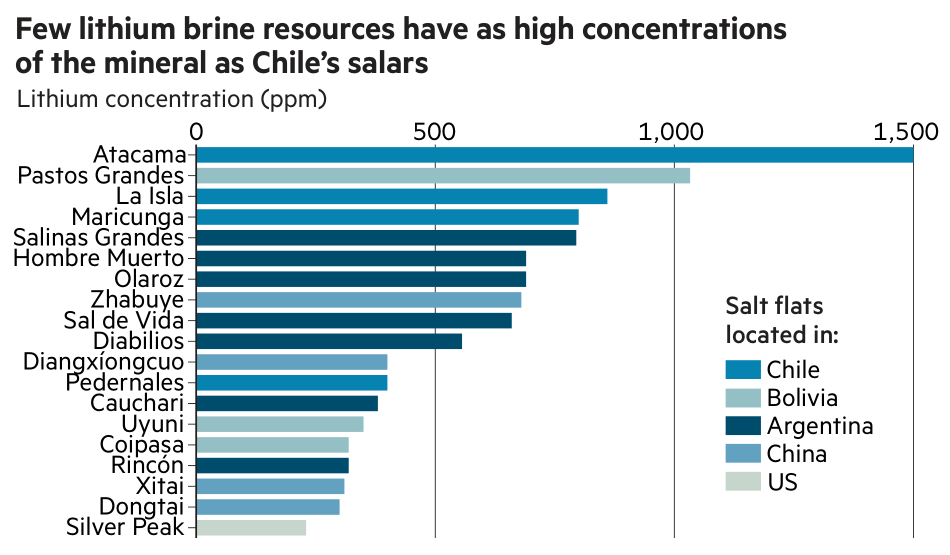

Almost 60 per cent of the world’s supply is there – specifically in the so-called Lithium Triangle in Chile, Argentina and Bolivia. This silvery- white substance is at the heart of the drive to shift from fossil fuels to renewables, especially when it comes to rechargeable batteries such as those used in electric vehicles and to store energy created by wind and solar farms. Demand for lithium is expected to increase fivefold by 2030 and then continue to rise.

So far so good for Chile, Argentina and Bolivia. But there’s a problem. They have the material; China has the ability to refine it and turn it into products. China buys most of Latin America’s lithium and refines more than half of the world’s supply. It manufactures 79 per cent of the world’s lithium-ion batteries.

The Russian invasion of Ukraine showed European governments, particularly Germany’s, the dangers of relying on a single supplier for energy. That, and Berlin’s economic dependence on its auto industry, explains the recent visit to Chile and Argentina by Chancellor Olaf Scholz.

The German leader took a large business delegation with him, and a number of deals were done on green technologies, but the focus was on lithium. Agreements were signed with both countries to increase cooperation on ‘sustainable mining’. He didn’t hide the fact that the move was designed to decrease reliance on China and challenge its dominance in South America.

The plan is for Germany to invest in the creation of lithium-refining factories in Argentina and Chile, and then buy the refined product directly from them, thus cutting out the middleman that is China. Germany’s relatively high environmental standards increasingly chime with both countries, giving it a boost in what will be serious competition with China for contracts.

Beijing has taken advantage of the relative absence of European companies to systematically build its supply chains and invest huge sums of money to buy into local companies. For example, Tianqi, which specialises in lithium, owns 28 per cent of SQM - Chile’s major chemical company.

Having seen China race into Africa to hoover up cobalt and other precious metals, the Europeans, and others, are also playing catch up in Latin America. Late last year, the EU agreed a deal with Chile for greater access to its lithium and copper, while the USA, Canada, Australia and South Korea all have a presence in the Lithium Triangle.

Despite sitting on the world’s largest lithium reserves, Bolivia is less of a player. This is partly because most of the lithium remains in the ground due to political instability in the country, badly run companies and a perception that successive left-wing governments presided over an investor-hostile environment. That’s now changing. President Luis Arce recently concluded a US$1 billion investment deal with a Chinese consortium to tap some of the country’s 21 million tonnes of known deposits. Part of the agreement is that lithium batteries will be made in Bolivia.

US Geological Service figures suggest that after Bolivia, Argentina has the largest lithium reserves (19 million tonnes) followed by Chile (9.8 million), the USA (6.8 million), Australia (6.3 million) and China (4.5 million). The UK has a few deposits as a minor element in granite, mostly in Cornwall, but not enough yet to justify industrial-scale mining. Instead, it has to import refined lithium and/or buy finished products that use it. However, the UK’s first lithium refinery is to be built on Teesside, with plans for it to produce enough lithium hydroxide for one million electric vehicles a year once finished. If successful, it’s likely to be the only lithium refinery in Europe and will reduce reliance on products from China.

In previous centuries, most countries that produced coal at industrial levels were able to position themselves as leading economies. Gas and oil played a similar role. The ‘white gold’ of lithium, along with other metals, such as copper and silver, may do the same for some of the countries where they’re found in abundance.

As a result, several governments in South America have the opportunity to drive hard bargains and fundamentally reshape their economies and perhaps the world’s balance of power. The ‘untold riches’ have been found.

볼리비아 우유니 사막에 리튬이 대량으로 매장되어 있지만

칠레나 아르헨티나에 비해 비용이 많이 드는 이유는?

아래 링크에~

https://www.mining.com/web/bolivia-revolutionaries-lithium-miners-go-die/

건조한 Altiplano-Puna 지역에 어떻게 물이 리튬을 포함한 지하수가 지속적으로 공급이 될까?

라는 비밀의 열쇠는 아래 기사에~

https://earthobservatory.nasa.gov/images/152528/mining-lithium-in-argentina

Mining Lithium in Argentina

View more Images of the Day:

earthobservatory.nasa.gov

'지역별 자료 > 남아메리카(라틴)' 카테고리의 다른 글

| 브라질 아마존의 Oil field (0) | 2023.06.09 |

|---|---|

| 제철업체는 신재생에너지의 천국 브라질로 가자 (0) | 2023.03.18 |

| 라틴 아메리카 슬럼의 변화 (0) | 2023.01.15 |

| 아마존 사바나 지역의 농경지화 (0) | 2022.08.18 |

| 아마존 고속도로 따라 열대우림 파괴 (0) | 2022.05.09 |